Content

You will see cases where your’ll have to offer the TIN (Taxpayer Personality Number), including making an application for a job, starting a bank account, or joining a financial investment membership having an excellent stockbroker platform. Supply the expected guidance and wait for the TIN to be validated.

- It managed to apprehend many of these online sellers of fake TINs a year ago.

- That it mobile app provides all the taxpayer the comfort and you will capability of characteristics complete for the digital programs.

- If or not as a result of lead contact with the new BIR, on line products, otherwise legal advice, guaranteeing the accuracy and you will validity of your TIN can prevent legal liabilities and you can support seamless deals.

- He said the new BIR will continue to deal with go-inside the recognition and you will issues on the TINs in the agency’s area practices in order to serve taxpayers without entry to that it mobile provider.

Somehow, within existence, youwill haveto pick a home of the ownwhich will make it very important to safe a good TIN. I’m writing to find your judge advice concerning your confirmation out of my Taxpayer Identification Amount (TIN). I need to make certain that my personal TIN is correct and you can appropriate to have compliance which have taxation regulations in the Philippines. Can you be sure to book me to your tips, courtroom provisions, and considerations surrounding this process? The new Taxation Character Amount (TIN) is a vital component of the new Philippine tax system.

- I would like to determine if it is possible to access my personal TIN as a result of on the web systems available with the us government and other signed up form.

- The same info are expected to possess TIN Recognition demands together with your TIN.

- A good taxpayer you are going to consult advice myself when you go to the newest Revenue District Workplace (RDO) where its TIN try joined.

Verifying TIN made easier, BIR launches the official mobile app | stake

Since the TIN Verifier software is the most much easier tool, you can also contact the new BIR thru current email address or cellular phone for guide confirmation. It was able to apprehend some on the internet vendors out of fake TINs this past year. Your cam record immediately clears aside on closing the fresh software, so there’s no punctual whether to watch for you to definitely verify your inquire or loose time waiting for a notification to-arrive.

Make certain together with your employer

Granted by the Bureau out of Internal Money (BIR), a TIN serves as a new identifier for taxpayers, whether somebody otherwise organizations, ensuring correct recording and you may conformity which have taxation loans. Provided the pros, guaranteeing the newest authenticity away from a good TIN is vital, for both someone and you may organizations, to avoid things including punishment, fraud, and you will administrative difficulty. This information explores the key regions of TIN validation, the new actions in it, and the courtroom consequences of employing or depending on invalid TINs.

Check out the TIN Verifier Disclaimer and then click Just do it

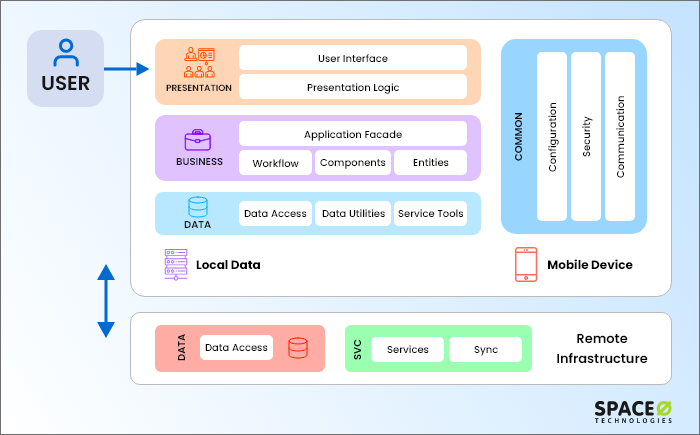

The brand new software lets taxpayers to ensure their TIN because of the distribution the personal stats, such as full name, birth time, and contact amount. Everyuser of one’s application try helped by the a customer provider member. A couple ofpersonal guidance was expected to ensure the new candidate’s label.

Funds gains pushes full-season 2022 finances shortage down seriously to 7.step 3 percent out of GDP

But not, this particular service is now available for the brand new registrants just and you can does not serve taxpayers seeking recover an existing TIN. Opening the newest eRegistration portal demands earliest private information which is subject to certain qualification requirements. But not, that have evolving tech and the public’s need for much more available functions, government entities has begun to implement digital answers to improve taxpayer availableness. In the past, the newest recovery away from a great TIN necessary bodily communication to your BIR. A great taxpayer you’ll demand guidance in person when you go to the new Funds Section Office (RDO) where the TIN is joined.

Download the program

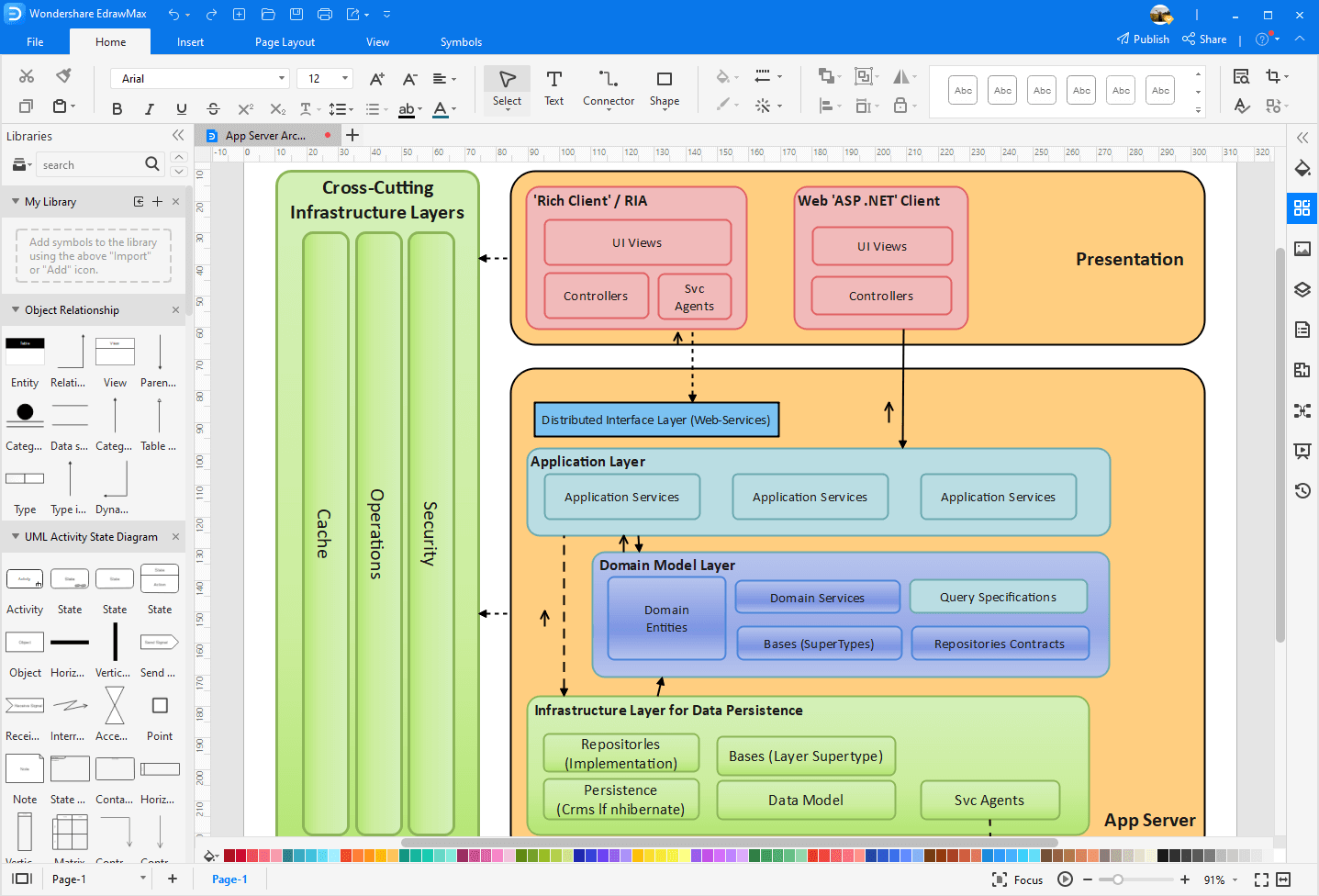

All the characteristics about the BIR, depending on stake BIR Deputy Commissioner Arnel Guballa, need to be available to techniques in most their Funds Area Workplaces (RDOs) for those who like to go to individually. TheBureau out of Internal Cash (BIR) launched its basic cellular software forTaxpayer Personality Matter (TIN) Verification as an element of the digitaltransformation work. With this particular, taxpayers can certainly take a look at its TIN usingtheir mobiles and will rating quick real-day answers of theconcerned BIR work environment. The brand new Taxation Character Amount (TIN) is a significant identifier to own taxpayers regarding the Philippines, granted by Bureau out of Internal Funds (BIR). Whether you’re a worker, a business owner, otherwise an individual generating earnings, the TIN is necessary for several monetary and you will judge purchases.

Forinstance, if the mission would be to consider TIN validation, advice such as the TIN,full name, birthday celebration, target, civil condition, partner name (if appropriate),and you may photos of your own legitimate ID along with your selfie inside it are expected. The client provider representative often helpusers all through the method and you can after accomplished, various other notificationmessage will appear. Guballa said the new BIR introduced the fresh cellular software last January while the an element of the agency’s electronic sales system.

Underneath the Study Confidentiality Act away from 2012 (Republic Work No. 10173), taxpayers need availableness their personal data, along with their TIN, considering it follow procedural standards. The brand new BIR even offers a task to safeguard taxpayer investigation while you are getting components for confirmation and modification away from details. The newest Taxpayer Personality Count (TIN) are a different identity count given by the Agency away from Interior Funds (BIR) to all taxpayers in the Philippines. It serves as the primary reference for everyone taxation-related transactions.

While you are on line entry to TINs in the Philippines stays restricted, advancements like the TIN Verifier Cellular Application show extreme steps on the boosting taxpayer features. Taxpayers are advised to fool around with certified channels for the TIN-relevant issues and to stand informed on the coming advancements inside the government digitalization work. The newest TIN Verifier Cellular App, brought because of the BIR, are a more recent innovation aimed at dealing with inquiries associated with TIN.

Prevent 3rd-group services who promise expedited running however, use up all your proper certification. Prior to talking to a customer provider agent, be ready for the info that will be asked for so you can be sure your own term, for example name, target, and you will birthdate. The fresh TIN are a lifestyle matter and does not alter regardless out of changes in civil position, a job, or team membership.

The deficiency of an intensive program to own on the internet TIN recovery stems from inquiries more study confidentiality and you will protection. The knowledge Confidentiality Act away from 2012 (Republic Operate No. 10173) imposes rigid standards to own protecting private information kept in government database. Not authorized entry to a great taxpayer’s TIN may lead to abuses for the law, launching the fresh BIR to help you prospective obligations. I am composing to seek their advice out of a concern I has in the confirming the fresh authenticity out of a good Taxpayer Character Count (TIN). In the today’s electronic years, I understand you to definitely fake TINs or phony registrations can cause high court and you will monetary effects. To be sure conformity which have tax legislation and stop potential obligations, I wish to recognize how I’m able to show in the event the a great TIN are legitimate playing with available on the internet otherwise certified info.

Below Philippine tax laws, specifically Part 236 of your National Interior Money Code (NIRC), while the revised, all of the individuals prone to pay any internal revenue taxation are expected to join up and you may safer a good TIN. Non-conformity, for example incapacity to join up otherwise deliver the right TIN, can lead to punishment. Verifying the new authenticity from a great TIN are a significant step in keeping compliance having Philippine income tax laws. The newest BIR will bring obtainable products and you can resources to assists this process, making sure taxpayers can easily locate and you may target people inaccuracies.